distribution code of 1b in box 7 of your 1099-r If you started your 2023 return in TurboTax, you generally have until October 31 to . Vintage 1968 Cowboy in Africa Metal Lunchbox with Thermos. Find great deals on eBay for Wild Wild West Lunch Box. Shop with confidence.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

Metals are excellent EMF blockers due to their high conductive nature. If you’ve ever gotten a medical x-ray, you may remember being asked to wear an apron made of lead. This is a great real-life application that demonstrates metal’s ability .

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.Enter the Form 1099-R exactly as received by entering both codes 1 and B. These .We're excited to announce our newest series of TurboTax Community Tax .If you started your 2023 return in TurboTax, you generally have until October 31 to .

We would like to show you a description here but the site won’t allow us. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

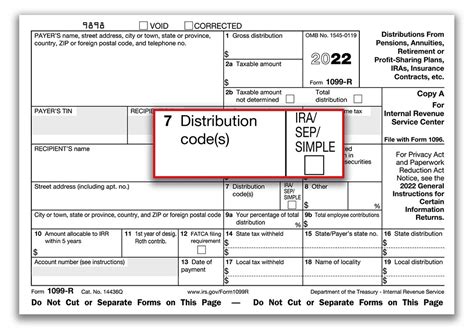

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Enter the Form 1099-R exactly as received by entering both codes 1 and B together in one box. These two codes together indicate that you made a distribution from a .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified . 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code .

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Enter the Form 1099-R exactly as received by entering both codes 1 and B together in one box. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

what does code 7d mean

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the separate treatment. You won’t be able to enter both codes in the. field. Per Form 1099-R Instructions, you can enter a numeric and an alpha code. For example: Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is . 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Enter the Form 1099-R exactly as received by entering both codes 1 and B together in one box. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the separate treatment. You won’t be able to enter both codes in the. field. Per Form 1099-R Instructions, you can enter a numeric and an alpha code. For example:

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

irs 1099 box 7 codes

VFI Fabrication LLC is located at 300 Thomas Ave Suite 101 in Williamstown, New Jersey 08094. VFI Fabrication LLC can be contacted via phone at 856-629-8786 for pricing, hours and .

distribution code of 1b in box 7 of your 1099-r|1099 r distribution code m2